Pvm Accounting for Beginners

Pvm Accounting for Beginners

Blog Article

Facts About Pvm Accounting Revealed

Table of ContentsThe Definitive Guide to Pvm AccountingPvm Accounting Things To Know Before You Get ThisThe 25-Second Trick For Pvm AccountingMore About Pvm AccountingThe Definitive Guide to Pvm AccountingPvm Accounting Fundamentals Explained

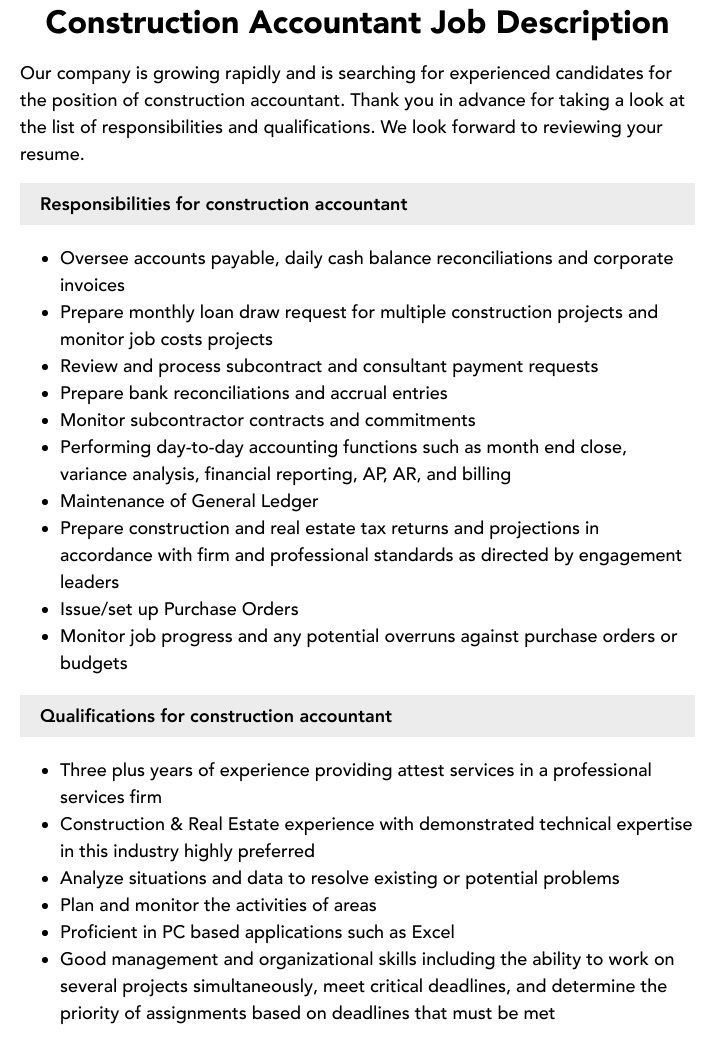

Manage and take care of the production and authorization of all project-related payments to customers to foster great communication and avoid problems. financial reports. Guarantee that proper records and paperwork are sent to and are updated with the internal revenue service. Ensure that the audit process abides with the law. Apply called for building and construction bookkeeping criteria and procedures to the recording and coverage of building activity.Understand and maintain standard expense codes in the audit system. Interact with numerous financing agencies (i.e. Title Business, Escrow Company) pertaining to the pay application process and needs required for settlement. Take care of lien waiver disbursement and collection - https://www.openlearning.com/u/leonelcenteno-sduppk/. Monitor and deal with bank issues consisting of charge abnormalities and examine differences. Assist with applying and preserving interior economic controls and procedures.

The above declarations are intended to explain the general nature and degree of work being performed by people designated to this category. They are not to be interpreted as an extensive checklist of responsibilities, responsibilities, and skills called for. Workers may be required to execute tasks outside of their normal duties periodically, as needed.

The Single Strategy To Use For Pvm Accounting

You will aid sustain the Accel group to guarantee shipment of successful on time, on spending plan, jobs. Accel is looking for a Building Accounting professional for the Chicago Office. The Building and construction Accountant performs a variety of audit, insurance policy compliance, and job management. Functions both separately and within certain departments to maintain financial documents and make sure that all documents are maintained present.

Principal duties include, but are not restricted to, handling all accounting features of the company in a prompt and exact manner and providing records and routines to the business's CPA Firm in the preparation of all monetary declarations. Guarantees that all bookkeeping procedures and features are handled properly. Liable for all economic documents, pay-roll, financial and day-to-day operation of the accounting feature.

Works with Project Supervisors to prepare and post all month-to-month billings. Produces monthly Job Price to Date records and working with PMs to reconcile with Job Supervisors' budget plans for each project.

Things about Pvm Accounting

Effectiveness in Sage 300 Construction and Property (formerly Sage Timberline Workplace) and Procore building and construction monitoring software application a plus. https://hub.docker.com/u/pvmaccount1ng. Need to additionally be proficient in other computer system software application systems for the prep work of reports, spread sheets and other bookkeeping evaluation that might be required by administration. construction accounting. Should possess solid organizational abilities and capability to focus on

They are the financial custodians that make sure that building tasks continue to be on spending plan, adhere to tax guidelines, and maintain financial openness. Construction accounting professionals are not simply number crunchers; they are tactical companions in the building procedure. Their main duty is to manage the financial aspects of building and construction projects, making sure that sources are assigned effectively and monetary dangers are minimized.

More About Pvm Accounting

By preserving a limited grip on job funds, accounting professionals assist prevent overspending and monetary obstacles. Budgeting is a foundation of effective building and construction jobs, and construction accountants are important in this regard.

Navigating the complicated web of tax policies in the building sector can be challenging. Construction accounting professionals are fluent in these guidelines and make sure that the task complies with all tax requirements. This includes handling pay-roll taxes, sales taxes, and any type of various other tax obligation responsibilities specific to construction. To master the role of a building accountant, people require a strong educational structure in bookkeeping and finance.

Additionally, accreditations such as Licensed Public Accounting Professional (CPA) or Licensed Construction Sector Financial Professional (CCIFP) are very related to in the industry. Working as an accounting professional in the building industry includes an unique collection of challenges. Building and construction jobs often entail limited deadlines, changing guidelines, and unforeseen expenses. Accountants have to adapt rapidly to these difficulties to maintain the task's financial health intact.

More About Pvm Accounting

Professional accreditations like CPA or CCIFP are additionally extremely recommended to demonstrate competence in building bookkeeping. Ans: Construction accountants create and check spending plans, recognizing cost-saving chances and making sure that the project stays within spending plan. They likewise track costs and projection financial demands to stop overspending. Ans: Yes, construction accountants handle tax conformity for construction projects.

Introduction to Building Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms need to make hard choices among many monetary choices, like bidding on one job over an additional, selecting funding for products or equipment, or setting a project's profit margin. Building is an infamously volatile industry with a high failure price, slow time to repayment, and irregular cash flow.

Manufacturing entails repeated processes with conveniently identifiable costs. Manufacturing needs different procedures, materials, and equipment with differing expenses. Each job takes area in a new location with differing website conditions and unique obstacles.

Pvm Accounting Fundamentals Explained

Frequent use of different specialized service providers and providers impacts efficiency and cash money flow. Payment arrives in full or with normal payments for the full contract quantity. Some portion of settlement might be kept till project completion even when the service provider's job is ended up.

While conventional makers have the benefit of regulated environments and enhanced manufacturing processes, construction companies need to continuously adjust to each new job. Also rather repeatable jobs need adjustments due to site conditions and other Recommended Reading aspects.

Report this page